Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

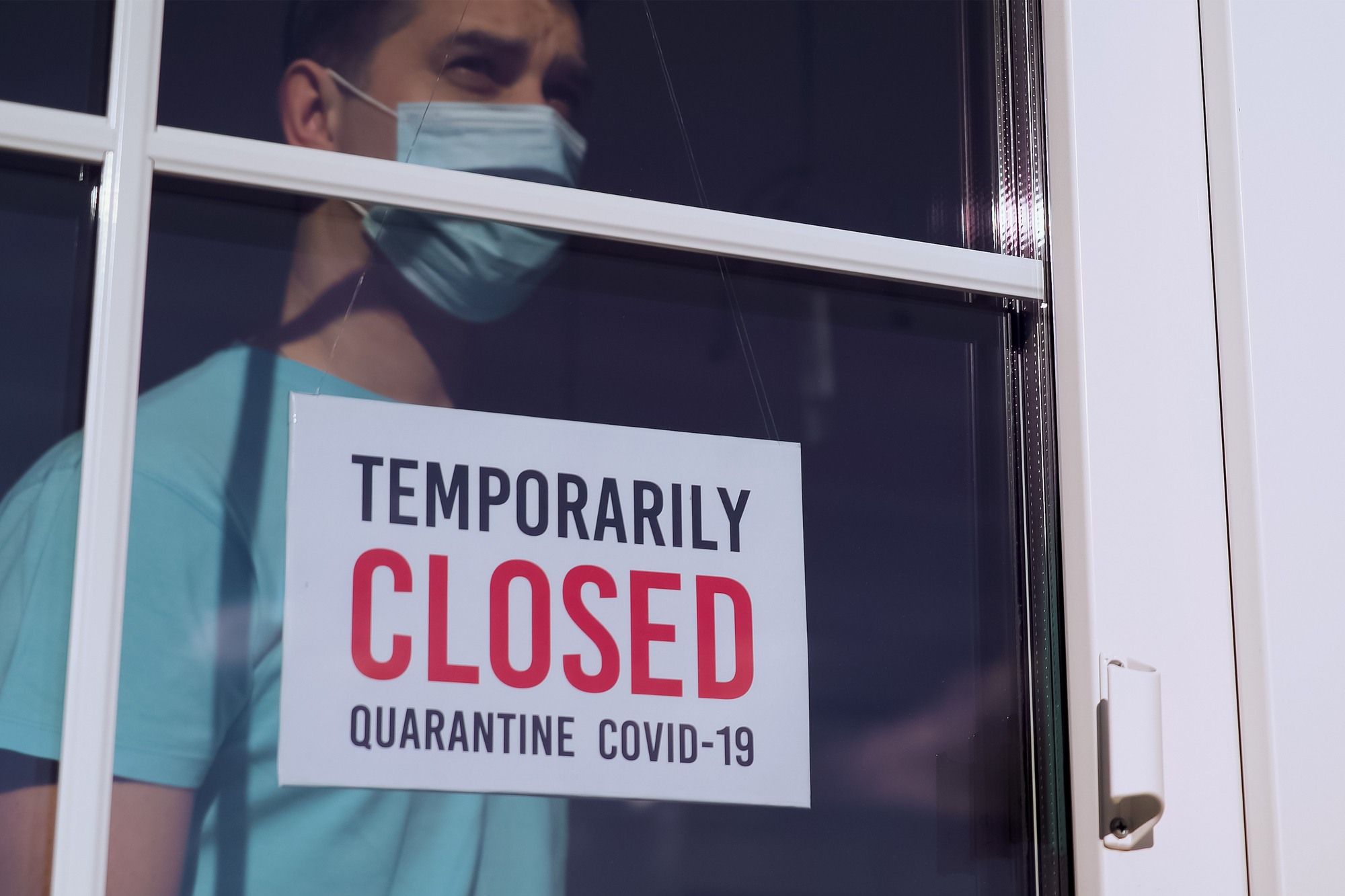

The COVID-19 pandemic has wreaked havoc throughout the world. As governments took steps to prevent the spread of COVID-19, the coronavirus effects took a toll on businesses that were forced to shut down or significantly limit their operations. Many businesses claim they had business interruption coverage but their insurance providers denied their claims despite arguments from business owners that the pandemic had, indeed, interrupted their businesses.

What is Business Interruption Insurance?

Business interruption insurance Canada is a type of insurance coverage for business owners that kicks in when an insured event causes a business to experience an interruption in revenue. The types of business interruption insurance coverage depend on the specific terms of the policy. Each policy will specify what types of perils are covered by business interruption insurance coverage.

The law is currently unclear about whether business interruption insurance coverage applies to loss of revenue related to the COVID-19 shutdowns. A growing number of Canadian businesses have raised concerns that their insurers are denying business interruption claims stemming from the coronavirus effects.

Business interruption insurance coverage typically reimburses policyholders for income lost due to the business interruption and additional expenses, such as the cost of temporarily relocating the business, if applicable.

Does Business Interruption Insurance Apply to Coronavirus Effects?

In the wake of the COVID-19 shutdowns, some insurance companies have refused to pay for business interruption losses due to coronavirus effects. Typically, they will only allow business interruption claims for physical damage to the business, and some policies may specifically exclude business losses that are related to epidemics, pandemics and other public health issues.

A growing number of business owners are taking legal action seeking to have business interruption insurance coverage applied to the losses they suffered during the COVID-19 shutdowns.

Recently, there have been court cases filed in the United States that claim the presence of COVID-19 on a surface can trigger the business interruption insurance coverage. There has been no ruling on this legal issue and it is unclear how a judge would rule on the matter. It is also unclear if different judges will reach similar outcomes regarding the application of business interruption insurance to coronavirus effects.

Some state legislatures have introduced bills that would require insurance companies to honor business interruption insurance coverage if the policy was in force at the time a state of emergency was declared due to COVID-19.

So far, none of the Canadian provinces have indicated that they will consider similar legislation to apply business interruption insurance coverage to loss of revenue caused by the COVID-19 state of emergency and related shutdowns. However, it is possible that they will pressure insurance companies to pay business interruption claims for losses caused by the COVID-19 shutdown orders.

How Much Business Interruption Insurance Do I Need?

The amount of business interruption insurance you need to protect your business depends on a number of factors. Insurers will typically impose a coverage limit for business interruption insurance coverage. That means the insurer will pay up to a certain maximum amount and you’ll be on the hook for any additional financial losses that exceed the coverage limit.

Some factors to consider when determining how much business interruption insurance you require are the length of time it would take your business to get up and running again after a loss, whether the building’s fire alarms and sprinklers are functional, and how quickly you would be able to find a temporary location for your business if you suffer an interruption in your revenue due to a fire or other physical damage.

What to Do if Your Business Interruption Insurance Canada Is Denied

If your insurance company denies your claim for business interruption insurance coverage, you have a few options. Your insurance company likely has an appeals process that you can follow to ask them to review your claim. Insurance companies may also require you to mitigate your losses as much as possible. For example, if you own a gym that was forced to close during the COVID-19 pandemic, the insurer may require you to find other ways to earn income, perhaps by offering online fitness classes until the restrictions are lifted. If your legitimate business interruption claim was denied a lawyer can help you fight for the coverage you deserve.

Do I Have a Business Interruption Insurance Legal Claim?

If you are a B.C. business owner who was denied business interruption insurance coverage after closing due to coronavirus effects, you may have a legal claim. Insurance companies have an interest in denying claims, especially in a global disaster like the COVID-19 pandemic, which has affected a vast number of businesses. A skilled lawyer can review your situation and determine if your policy included business interruption insurance coverage, and if so, if the insurance company wrongfully denied your claim. Submit your information now for a free policy evaluation by a lawyer.

Read More Lawsuit & Settlement News:

Business Interruption Insurance Class Action Lawsuit Alleges “Unlawful” Claim Denial

Long Term Disability Lawyer | Insurance Claim Denial Help

Canada Roundup Glyphosate Cancer Class Action Lawsuit Investigation

Airline Ticket Refund Class Action Lawsuits Reach Supreme Court of Canada

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.